News, 23 February, 2026

Last week, the European Union approved an update to the EU list of non-cooperative jurisdictions for tax purposes (the so-called “black list”), officially adding Vietnam alongside the Turks and Caicos Islands. In the same update, Trinidad and Tobago, Fiji and Samoa were removed from the black list as they are…

News, 1 September, 2025

We are proud to share that Maryll Callari, Senior Associate at Tiberghien, has been appointed vice-president of the Tax Commission of AIJA, the International Association of Young Lawyers. In her new role, Maryll will collaborate with the Commission’s presidents, Clemens Willvonseder and Silvia Niubó Vidal, as well as fellow vice-president…

News, 24 June, 2025

On 6 February 2025, the European Court of Human Rights (ECHR) issued an important judgment in the case Italgomme Pneumatici S.R.L. and others v Italy. The ruling provides important insights on the relationship between the fundamental rights of a taxpayer and the exercise of investigative powers by the tax administration…

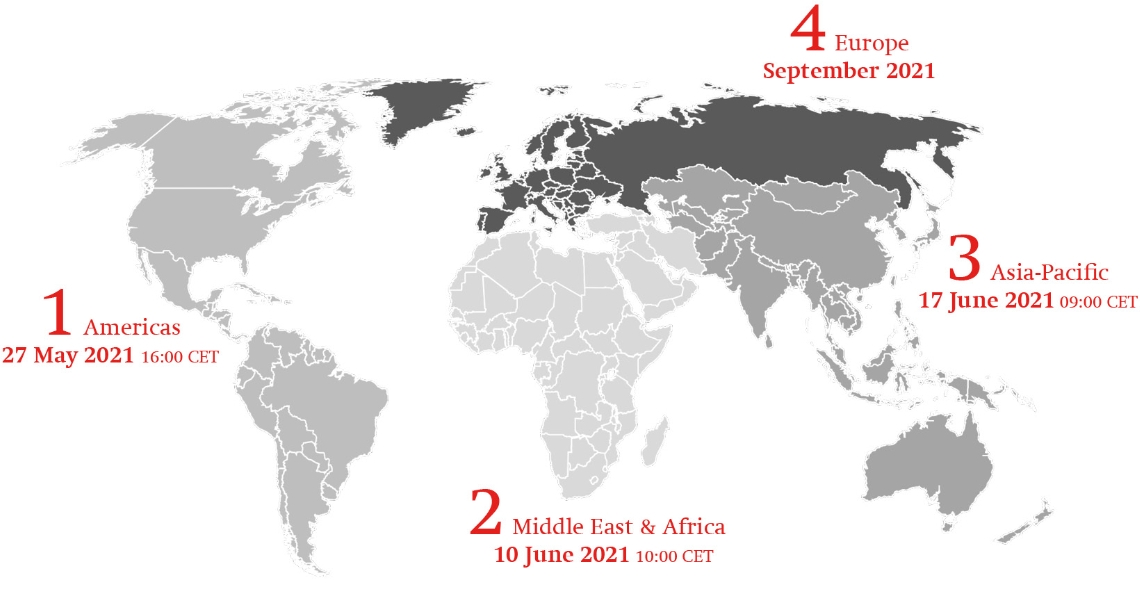

Global connectivity

Global connectivity