As from 1 July 2021, the e-commerce VAT package enters into force. As a result, online sales to private individuals will generally be subject to VAT in the EU Member State of arrival of the goods. To limit additional VAT liabilities for e-tailers, suppliers will be allowed to pay VAT that is due in several EU Member States via a single one-stop shop. This is also the case for distance sales of goods imported from third countries. However, unlike the one-stop shop for intra-Community distance sales (see our previous newsletter), the import one-stop shop (IOSS) can only be used for goods with a value not exceeding € 150. As a result, e-tailers should pay special attention when selling higher value goods that are imported from third countries. If not treated properly, customers could even end up paying the VAT twice.

Multiple simplifications for online sales of imported goods up to € 150

Under the new e-commerce VAT rules, e-tailers will have various options to limit their VAT liabilities in Europe when selling goods originating from third countries to the extent that the value of the goods does not exceed € 150.

Firstly, for e-tailers selling goods via their own webshops, application could be made of the import one-stop shop (IOSS). As a result, the import of the goods, regardless of the Member State in which the import takes place, will be VAT-exempt while the VAT on the distance sales of the imported goods can be paid via a special import one-stop shop return. The IOSS is available to e-tailers established inside as well as outside the EU. However, e-tailers not established within the EU will have to appoint a fiscal representative to do so.

Secondly, e-tailers could opt to sell the imported goods via an online market place or platform. When doing so, the e-tailer’s VAT liabilities are shifted to the operator of the online market place or platform. According to a new deeming provision, distance sales of imported goods with a value up to € 150 will be deemed to be made by the operator of the platform facilitating the online sale. Consequently, the operator of the platform will be liable to fulfil the EU VAT obligations. It is to be expected that operators of online market places and platforms that are caught by this deeming provision will opt for the IOSS.

When the IOSS is not applied (by the seller or market place), goods can only be released into free circulation in the Member State where transport to the final consumer ends (Article 221 (4) Implementing Regulation 2015/2447). As a result, the distance sale can only take place in the EU VAT territory when the supplier is named as the importer of record on the import document. In the opposite case, where the final consumer is named as the importer of record, VAT will only become due on the import.

Having said that, the e-tailer could hence also opt to shift the VAT liability to the final consumer by having the latter named as the importer of record on the import declaration. As a result, the final consumer will be confronted with an additional VAT claim from the logistics provider who pre-financed the VAT upon the importation of the goods in the name and on behalf of the final consumer. In this respect, a simplified scheme has been introduced for the logistics providers under which the VAT can be transferred on a monthly basis.

Finally, the e-tailer could opt to register for VAT purposes in the different EU Member States where the distance sales are deemed to take place. In this case, VAT is also collected by the seller but paid via periodical VAT returns filed in several EU Member States instead of via the IOSS regime. As noted above, this option implies that the seller is named as the importer of record on the import document.

Limited possibilities for online sales of imported goods with a value exceeding € 150

The e-commerce market is evolving very quickly. While in the early stages of e-commerce, the market was characterised by small packages and low value goods, recent developments show that larger sized and higher value goods are quickly gaining ground in the e-commerce environment.

Against this background, it is definitely remarkable that the new e-commerce VAT rules offer little-to-no simplifications for online sales of goods above € 150. Both the application of the IOSS as well as the simplification for logistics providers are limited to goods with a value up to € 150. Moreover, the deeming provision for online sales of imported goods facilitated by online market places or platforms does not apply when the goods have a value exceeding € 150.

E-tailers selling higher value goods could of course also opt to shift the entire VAT liability to the final consumer by having the latter named as the importer of record on the import declaration. As a result, the final consumer will be confronted with an additional VAT claim from the logistics provider who pre-financed the VAT upon the importation of the goods in the name and on behalf of the final consumer. It goes without saying that this is not the best option from a commercial point of view.

Alternatively, e-tailers could opt to register for VAT purposes in the different EU Member States where the distance sales are deemed to take place. As such, VAT can be collected by the supplier, which avoids the customer being confronted with an additional VAT claim afterwards. It is in this situation that the seller should particularly pay attention when instructing the customs broker. More specifically, e-tailers should make sure that the final consumer is not named as the importer of record on the import document. Otherwise the final consumer might end up paying the VAT twice. We will clarify this situation with two basic examples:

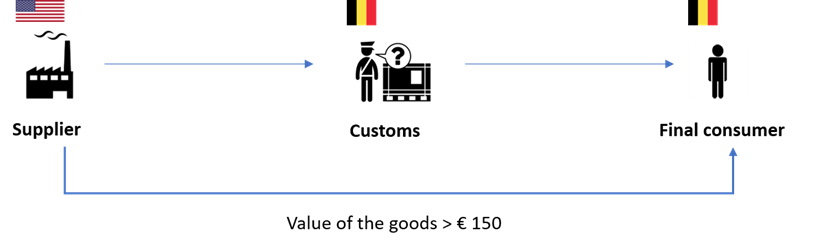

Example 1:

In this example the goods are imported via the port of Antwerp in Belgium and subsequently transported to the final consumer in Belgium.

In the case where the supplier is named as the importer of record on the import declaration, the VAT treatment will be as follows:

- Import into Belgium: Belgian VAT due by the supplier but also recoverable;

- Distance sale of imported goods located in Belgium (Article 32 (2) of the EU VAT Directive / Article 14, § 2 (2) BE VAT Code).

In the case where the final consumer is named as the importer of record on the import declaration, the VAT treatment will be as follows:

- Import into Belgium: VAT due by the final consumer (pre-financed and collected by the logistics provider presenting the goods to Belgian customs);

- Distance sale of imported goods located outside the EU (Article 32 (1) of the EU VAT Directive / Article 14, § 2 (1) BE VAT Code).

It follows from the example above that the supplier can only avoid its customers being confronted with an additional VAT claim when the supplier itself is named as the importer of record on the import declaration. If the supplier collects and pays VAT on the distance sale to the consumer and erroneously has the final consumer named as the importer of record on the import document, then the final consumer will be confronted with an additional VAT claim and could end up paying the VAT twice. Since the distance sale will in this case be located outside the EU, the supplier could of course recover the VAT that was erroneously paid on the distance sale and subsequently transfer the recovered amount to the consumer; but it goes without saying that this will cause unnecessary ‘red tape’.

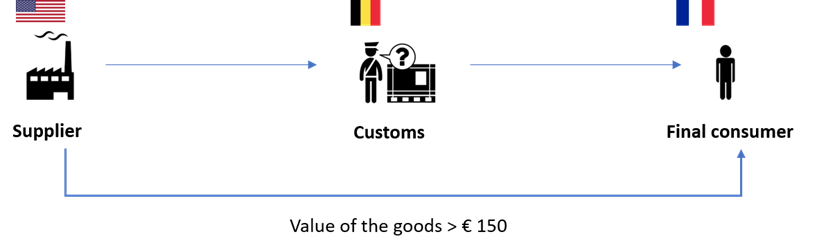

Example 2:

In this example the goods are imported via the port of Antwerp in Belgium and subsequently transported to the final consumer in France.

In the case where the supplier is named as importer of record on the import declaration, the VAT treatment will be as follows:

- Import into Belgium: Belgian VAT due by the supplier but also recoverable;

- Distance sale of imported goods located in France (Article 33 (b) of the EU VAT Directive).

In the case where the final consumer is named as the importer of record on the import declaration, the VAT treatment will be as follows:

- Import into Belgium: Belgian VAT due by the final consumer (pre-financed and collected by logistics provider presenting the goods to Belgian customs);

- Distance sale of imported goods located in France (Article 33 (b) of the EU VAT Directive).

Consistent with the example above, the supplier can only avoid its customers being confronted with an additional VAT claim when the supplier itself is named as the importer of record on the import declaration. If the supplier collects and pays French VAT on the distance sale to the consumer and has the final consumer named as the importer of record on the import document, then the final consumer will be confronted with an additional VAT claim and will end up paying both Belgian and French VAT on the same sale. Contrary to the example above, the new rules do not seem to provide an opportunity to correct this double taxation.

Stockpile higher value goods in Europe as an alternative

It is clear that suppliers have to be very careful with online sales of higher value goods imported from third countries. As outlined above, the different simplifications provided for in the new e-commerce VAT rules can only be used when it concerns goods with a value of up to € 150. To avoid the customers ending up paying the VAT twice, suppliers should make sure that they are named as the importer of record on the import declaration. This will lead to VAT liabilities in several EU Member States.

As an alternative, suppliers of higher value goods might consider building-up a stockpile in Europe. As a result, online sales of goods stocked in Europe will qualify as intra-Community distance sales for which VAT can be declared via the one-stop shop (Union scheme) irrespective of the value of the goods. As such, suppliers can sell higher value goods to consumers established all over the EU and fulfil all their VAT liabilities in only one EU Member State.

Suppliers could even opt to stockpile goods in Europe under a customs suspension regime (e.g. a customs warehouse). As such, EU import duties can be avoided when goods are sold to final consumers established outside the EU (e.g. final consumers established in Switzerland). Explanatory notes on the new e-commerce VAT rules confirm that goods placed in a customs warehouse in the EU are already on EU territory and hence cannot be considered as being dispatched from third countries.

Act now

E-tailers of higher value goods that are imported from third countries should carefully assess the impact of the new rules on their business model. At Tiberghien we have closely examined the new e-commerce VAT rules. If you would like any further information on these new rules, please do not hesitate to contact us.

Meet the Tiberghien indirect tax team